March 24, 2023

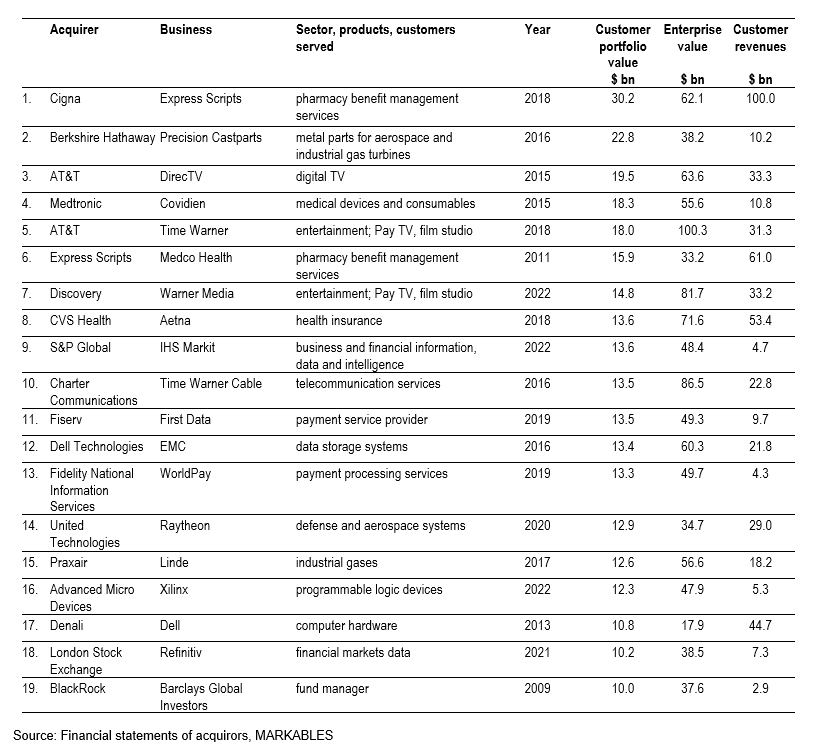

As per March 24, 2023, MARKABLES lists 12,571 acquired customer portfolios, their values, valuation parameters, earnings margins, useful lives and attrition rates. Nineteen of these 12,571 exceed the value threshold of $10 billion (see list below).

During the last 20 years, customer relations showed an impressive uptrend in the concert of different intangible assets that make up the value of companies. As can be seen from the valuation and accounting data from corporate acquisitions, the importance of customer relations increased in all different aspects. Today, customer portfolios have the highest share in enterprise value, the second highest earnings margin (behind software assets), and the highest occurrence rate. In other words: customer relations play a major role in M&A, corporate acquisitions and strategic management.

The portfolio of existing customers is the key asset for most businesses today. Looking closer at how the customer portfolio fits into the valuation of such businesses, we find wide differences. For the 19 largest cases, the customer portfolio accounts for 28% of enterprise value on average. The range goes from 16% to 60%. In relation to revenues, the value of the customer portfolio is 0.57x current annual revenues on average. Considering the individual attrition rates of customer relations, the applicable pre-tax excess earnings margin for these customer assets is in the area of 20% on revenues on average. “Winner” in the list is Worldpay where customer value is 3.1 x current annual revenues.

Some circumstances foster valuable customer relations: recurring revenues, subscription models, attrition rates/switching cost, direct relations with customers as opposed to sales intermediaries. Typically, we find such circumstances in sectors like entertainment/media, insurance, telecommunications, payment services, information and data services. We also find suppliers of physical products, however provided that their customers have a recurring/regular need for such products, and provided that the customer relation is direct and digitized.

Beyond the largest customer portfolios, we find customer relations reported in almost all corporate acquisitions. In the MARKABLES database, the average value of an acquired customer portfolio is $ 153mn. This compares to $ 218mn for product technology, $ 125mn for trademarks/brands, and $ 48.5mn for software.

MARKABLES is a commercial database for the valuation of intangible assets, with probably the widest selection of 40,500+ comparable cases. Intangible assets covered include customer relations, trademarks, software, product technology and goodwill. The database is accessible under various plans, from flexible one-offs and long-term high-volume users. We are the only vendor offering comparable data for the valuation of customer relations. Please feel encouraged to find out if we are different, and why we are better.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland