October 27, 2015

How much are brands worth? And what are the most valuable brands? Both media and academia are interested in these issues and cover them frequently. And the audiences like to discuss about brands they are familiar with. One major source that fuels these debates are rankings listing the purportedly most valuable brands of the world, of a specific region, or of a specific industry sector. Prominent and frequent publishers of such rankings are branding and brand valuation advisory firms Millward Brown (BrandZ), Interbrand and Brand Finance who release between 10 and 30 different brand value rankings each year. The most valuable brands currently include Apple, Google and Microsoft.

It is helpful to understand that all of these rankings are compiled pro bono, without client mandate and compensation, except for the considerable publicity related to their publication. Necessarily, the valuations of the ranked brands have to be performed from the perspective of an outside observer, deprived of access to essential inside information and data. It is like valuing a building based on pictures only, without access and personal inspection of the real estate.

Doubts about the accuracy of these rankings have been raised since long. All too obvious are the inconsistencies, i.e. brands that more than double or half their values from one year to the next, brands that are more valuable than the whole enterprise they belong to, or values of the same brand varying by a factor of 4x depending on the issuer. All doubts did however affect neither the vogue of the rankings nor their inconsistencies. The problem was that all these values were untested assertions, and nobody could test them in reality. There is only one meaningful reference to test the value of a brand: the price a buyer is willing to pay for it in a real transaction.

Now for the first time it was possible to test the values of 162 different brands from league tables against the reported and audited values which these brands obtained in real transactions, based on the MARKABLES database. The findings are disillusioning; the brand values compiled on the rankings are far off reality.

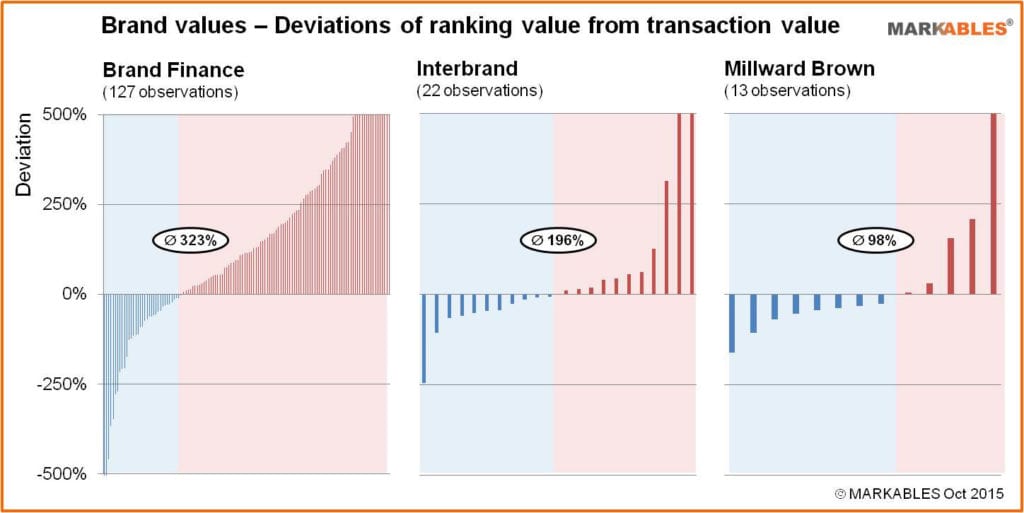

On average, a brand value from one of the league tables differs by more than 300% from its transaction value. Positive and negative differences cancelled out, brands on league tables overestimate their real value by a factor of 2.34. In other words, a brand value of US$ 10 billion reported on a league table is – in all likelihood – only US$ 4.3 billion in reality. On the other hand, there is a 33% risk that the value of a brand taken from a ranking under estimates its real value. As many as 91% of brand values reported on league tables fall outside an acceptable range of +/- 20% from the reference value. The chart illustrates the individual deviations found for each of the three firms Brand Finance, Interbrand and Millward Brown. Their head-to-head comparison shows the highest level of accuracy for Millward Brown, although still an average deviation of 98%.

The brand valuation specialists err for three major reasons. First, the valuation of brands is about their major subject – brands, and they tend to be positively biased. Second, they underestimate or neglect other valuable intangible assets that form part of a business, like technology, customer relations, licenses, landing rights, concessions etc. That is why the deviation is highest in industries like telecom (504%), airlines (499%), fuel stations (442%), and banks (390%) all of which have substantial intangible assets other than brand. And third, their methods are not developed to value B2B and other utility based brands with high profitability.

Many professionals and readers suspected since long that something must be wrong with the brand rankings. But few wanted to hear the doubts, and many wanted to believe that it was somehow possible to value brands this way. However, unsolicited brand valuations, without essential internal information, must necessarily provide low quality results. We should therefore not take these findings as a surprise. Transforming water into wine may have worked in a gospel, but it does not in business – at least not in the long run.

Please download the full report here (2,230 words, 5 exhibits, 5 tables, 1 list of brands)

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland