September 6, 2021

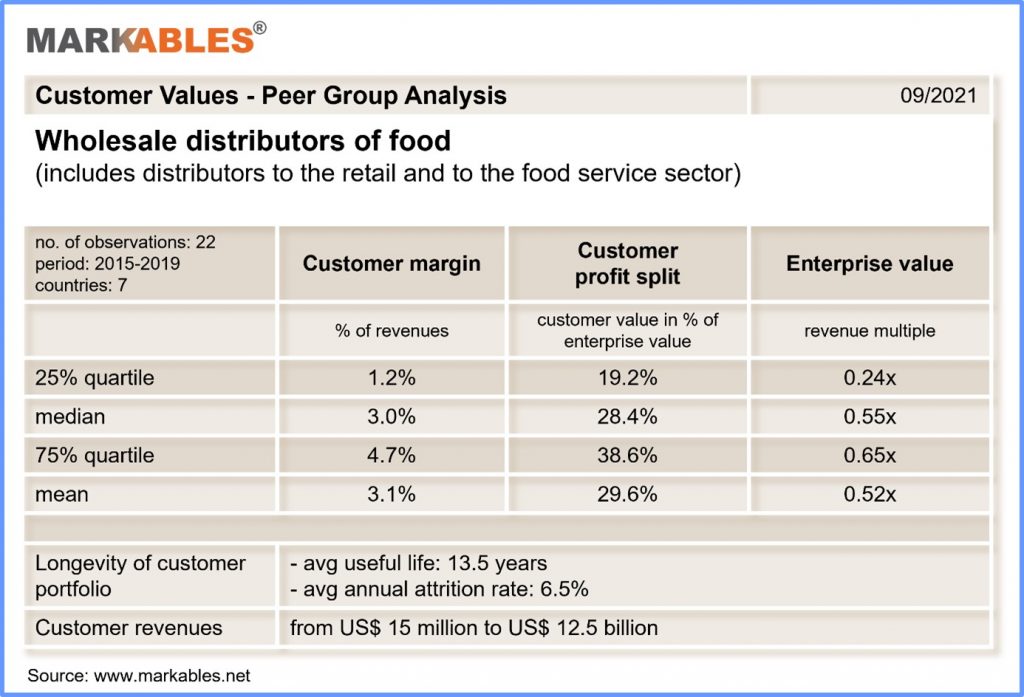

Customer value sector snapshot: In this post, we discuss the economics of customer relations and customer value. For this, we analyze various customer value ratios for a peer group of businesses engaged in the wholesale distribution of food, i.e. to restaurants or food retailers. The analysis includes 22 different wholesale food distributors in 7 countries, observed between 2015 and 2019.

It is obvious that such businesses live from lasting and profitable customer relations. Customer attrition is rather low, with 6.5% per year on average. One out of fifteen customers every year goes buying elsewhere.

In the absence of other important intangible assets (i.e. trade name, technology, software), customer relations is the largest asset class accounting for almost 30% of the enterprise value of wholesale food distributors on average.

This customer value is based on a profit margin that is generated from the existing customers (a customer profit margin or customer excess margin). This customer margin is 3% on sales on average. However, the customer margin shows a high bandwidth that correlates closely with overall profitability. On average, the customer margin is 30% of total pre-tax profit margin. If the total profit margin doubles, the customer margin would also double, and vice versa.

The value of customer relations plays an important role in corporate acquisitions, financial reporting, corporate taxation, and transfer pricing. MARKABLES provides comprehensive comparable data to value customer relations in all different sectors and context.

As often, there is a strong correlation of royalty rates and profitability in this sector. Based on the sales multiple (enterprise value to revenues) as profitability measure, the royalty rate on the brand name increases with increasing profitability of the underlying business. Or in other words: the profitability of businesses explains in large part the bandwidth of appropriate royalty rates in a particular sector.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland