July 15, 2014

The valuation of trademarks and brands under an income approach requires the projection of future brand-related income and the subsequent discounting to present value. The appropriate discount rate is to reflect risk associated with income projected in the future. The more risk is inherent in future brand related income, the higher the discount rate, and the lower the present value of such future income.

Discount rates under an income approach are typically derived with CAPM (capital asset pricing model), WACC (weighted average cost of capital) and WARA (weighted average returns on assets). Accordingly, the appropriate return of an asset should reflect its non-diversifiable, systematic market risk, and its different sources of capital. Typically, a discount rate analysis for a subject trademark starts with the WACC of the underlying business. From here, the appraiser starts to assign asset-specific risks to the different classes of assets. He has to analyze if the trademark specific risk is equal, higher or lower compared to the overall business risk. Some authors argue that trademarks require an additional illiquidity risk premium on top of WACC because they cannot be sold on active markets. Other authors argue that trademarks reduce volatility and make important contributions to stabilize future revenues of the business. Hence trademarks reduce business risk and discount rates. There is no consensus between these two lines of thought.

In practice, many trademark appraisers use the WACC of the business as base discount rate in the valuation of trademarks. The basic assumption is that all the revenues of the business are generated under the trademark, thus the revenue stream from the trademark has the same underlying risk than the one from the business. From there, they make the appropriate adjustments to arrive at the trademark specific discount rate.

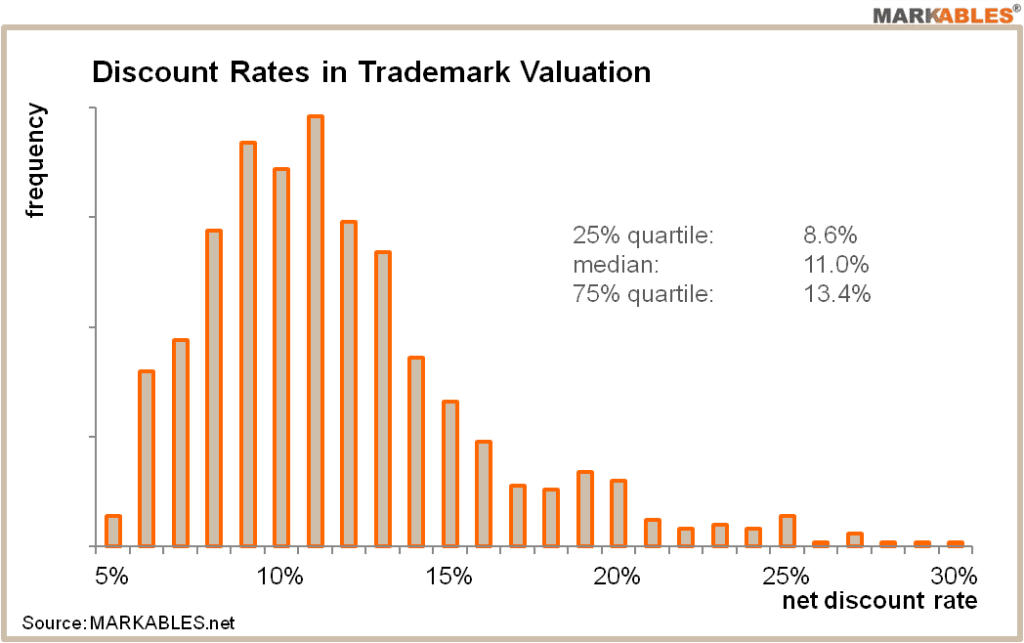

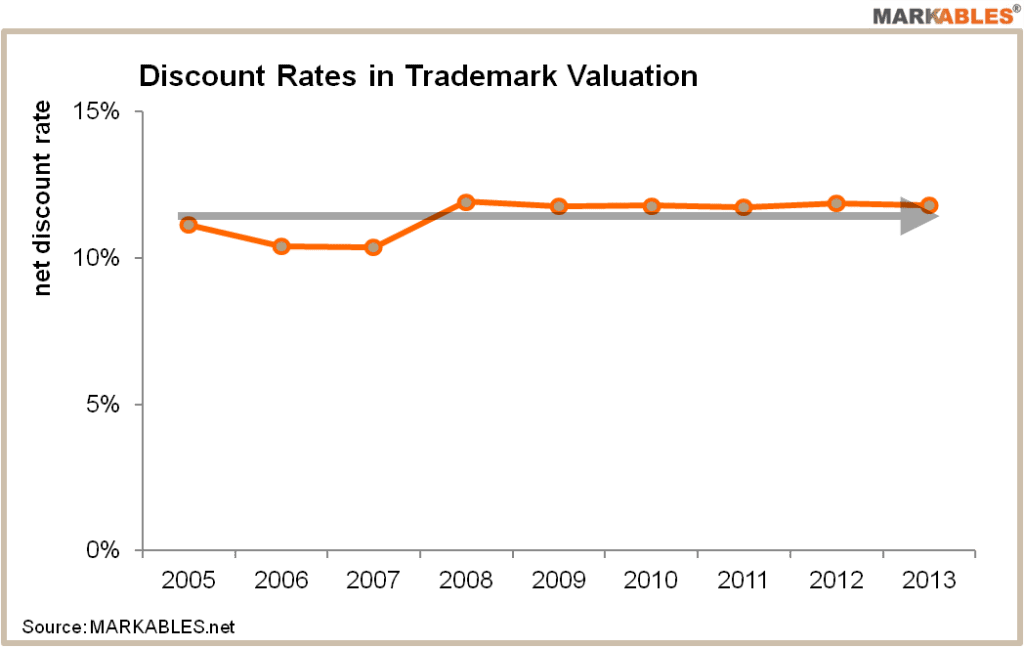

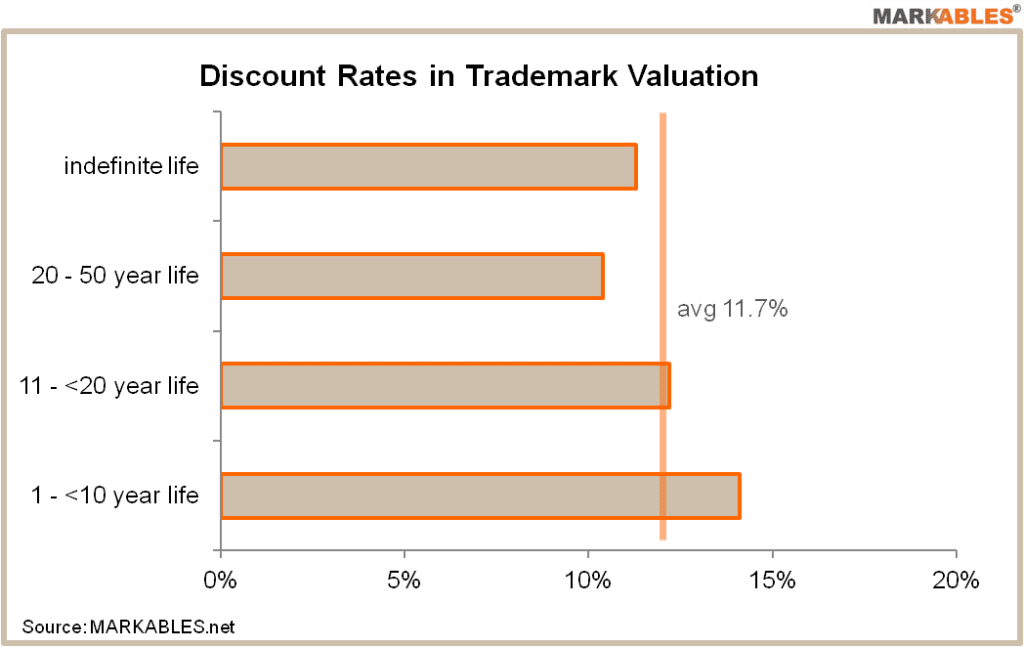

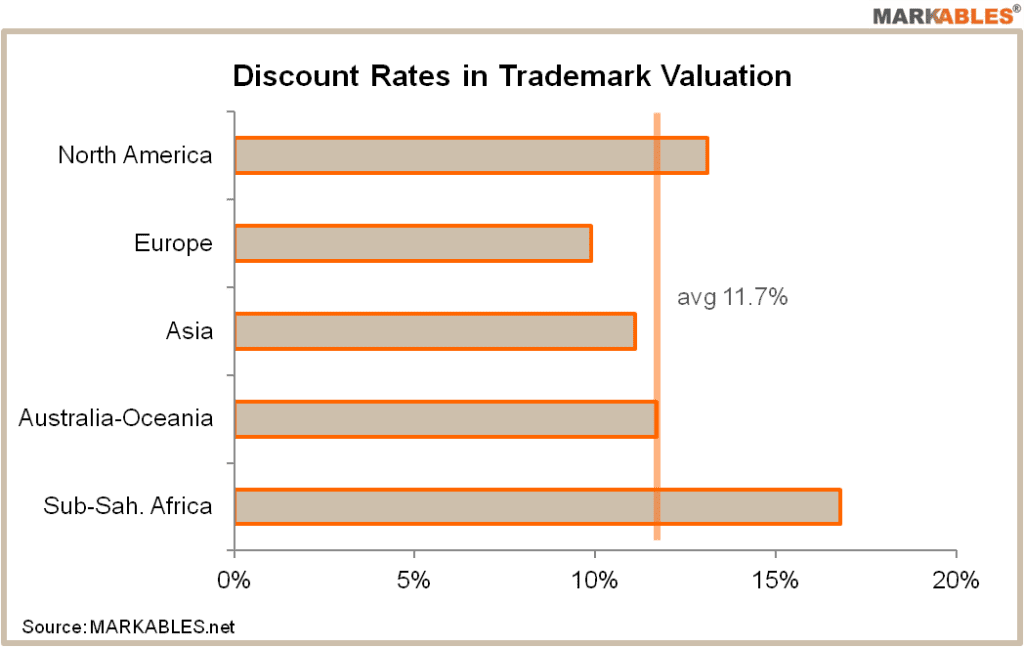

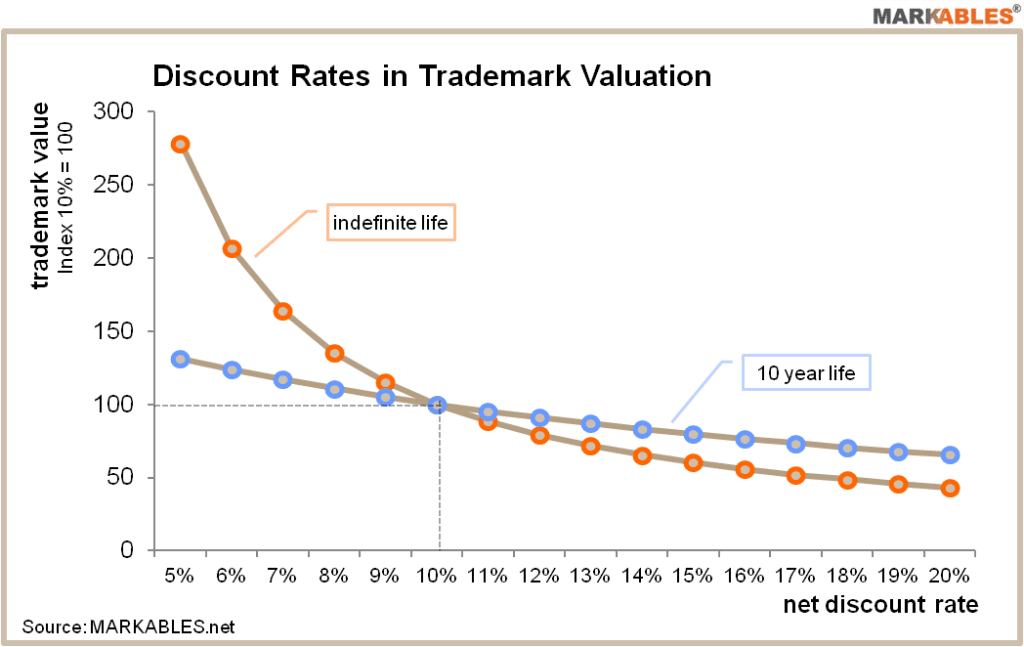

MARKABLES analyzed the net discount rates applied in nearly 1,000 trademark valuations worldwide between 2005 and 2013. Net discount rate means the pre-tax discount rate minus the long-term, constant growth rate beyond the planning period. Listed below are the major findings.

More details are illustrated in the charts below.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland