August 16, 2021

Intangible asset valuation in food delivery: The MARKABLES intangible value database shows what investors and acquirers pay for in the food delivery industry.

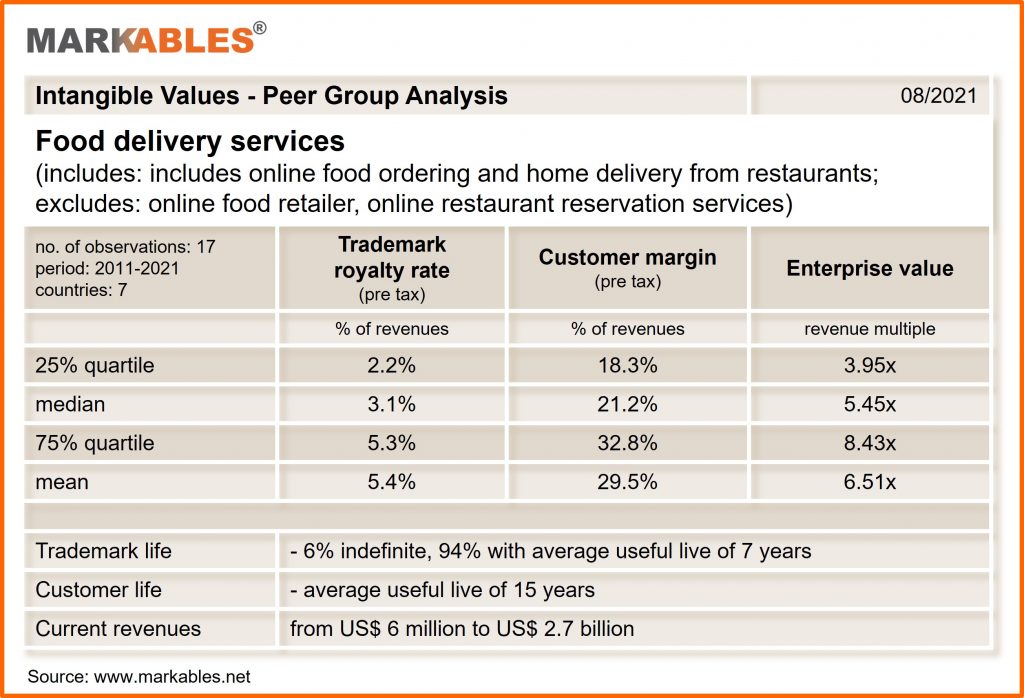

GrubHub, Just Eat, Ele.me, Delivery Hero, and BiteSquad are just a few names in the food delivery sector that changed hands recently. Their brand names are valued at royalty rates from 3% to 5% on revenues. In contrast, customer margins are not only much higher – from 20% to 30% on revenues – but also live much longer than brand names that are expected to be replaced after 7 years. The Investors’ and acquirers’ bets into future growth are huge.

Food delivery is one of the hottest topics these days and months or even years. This has several reasons. On the one hand, recent IPOs such as DoorDash (USA) in late 2020, Deliveroo (UK) in spring 2021, or Zomato (IND) in mid-July 2021 are generating broad-based attention. On the other hand, there is a lot going on on the M&A front. Worth mentioning is certainly the participation of the German company Delivery Hero in the English competitor Deliveroo, which has just been announced.

With all this activity, one credo seems to prevail in particular: Go big or get acquired. Food delivery companies consolidated like rabbits in 2020. The rush was in parts accelerated by the pandemic. But even more important: Only a few, very large players will survive in this market, and investors are buying into market positions, user databases and existing networks. Anyhow, there is at least one good message according to our data: Revenue multiples have already passed their peaks 4 or 5 years ago, and most targets today turn at least break even, if not profitable.

We had an in-depth look into 17 M&A-Cases in 7 countries in the food delivery industry between 2011 and 2021.

The purpose was to find out what the acquirer and the investors, respectively, paid for. The findings are not necessarily surprising, but nevertheless remarkable. Here is what we would like to share with you:

As an average the brand names are valued at royalty rates from 3% to 5% on revenues. In contrast, customer margins are not only much higher – from 20% to 30% on revenues, but also are expected to live much longer than brand names. As shown in the table above, the average useful live for the trademarks is assumed to be 7 years, the one of customer relations 15 years. This reflects the expectation that further consolidation will occur, and that brands will therefore disappear.

In summary, the data set of intangible assets acquired with food delivery businesses reveals a number of interesting aspects:

Acquirers and investors paid considerable prices for their stakes in competitors or financial investments. Roughly 2/3 of the investments are bets into the future (Goodwill). Let’s see if the risk taken is worth it.

Please find additional graphical analysis of customer margin and royalty rate data in the food delivery sector by clicking the link here.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland