June 7, 2022

Technology assets are amongst the most important intangible assets of enterprises. In June 2022, MARKABLES will launch a new set of comparable data, ratios and royalty rates to support the valuation of technology assets. This dataset comprises 3,000+ different cases of product technology, and another 2,800+ different cases of software. We would like to give a first glimpse about what our users can expect from product technology comps.

We have already posted a list of the ten most expensive technology portfolios we have on file and a benchmarking analysis of tech-related comps for manufacturers of passenger cars and commercial vehicles.

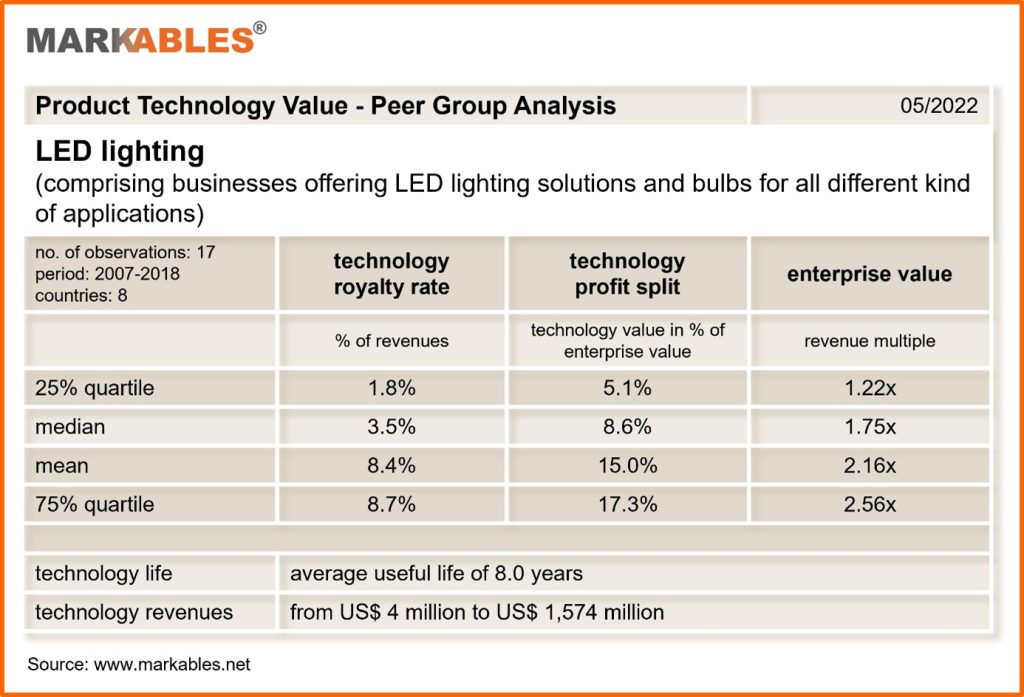

Now, we show another benchmarking analysis for tech-related comps and royalty rates, this time for manufacturers of LED lighting. Two things are directly visible. Royalty rates are significantly higher than for car manufacturers, with a median value of 3.5%. And there is a difference between median and mean values, indicating that the distribution of values is right skewed with some very high values at the upper end of the distribution. In other words – LED lighting businesses can be quite hi-tech. Technology stands for between 10% and 15% of enterprise value, next to other assets like customer relations, brand and goodwill. Based on profitability and growth prospects, sales multiples paid for LED lighting businesses are much higher than for car manufacturers.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland