June 2, 2022

Technology assets are amongst the most important intangible assets of enterprises. In June 2022, MARKABLES will launch a new set of comparable data, ratios and royalty rates to support the valuation of technology assets. This dataset comprises 3,000+ different cases of product technology, and another 2,800+ different cases of software. In this post, we give a first glimpse about what our users can expect from product technology comps.

To begin with, we presented a list of the ten most expensive technology portfolios we have on file.

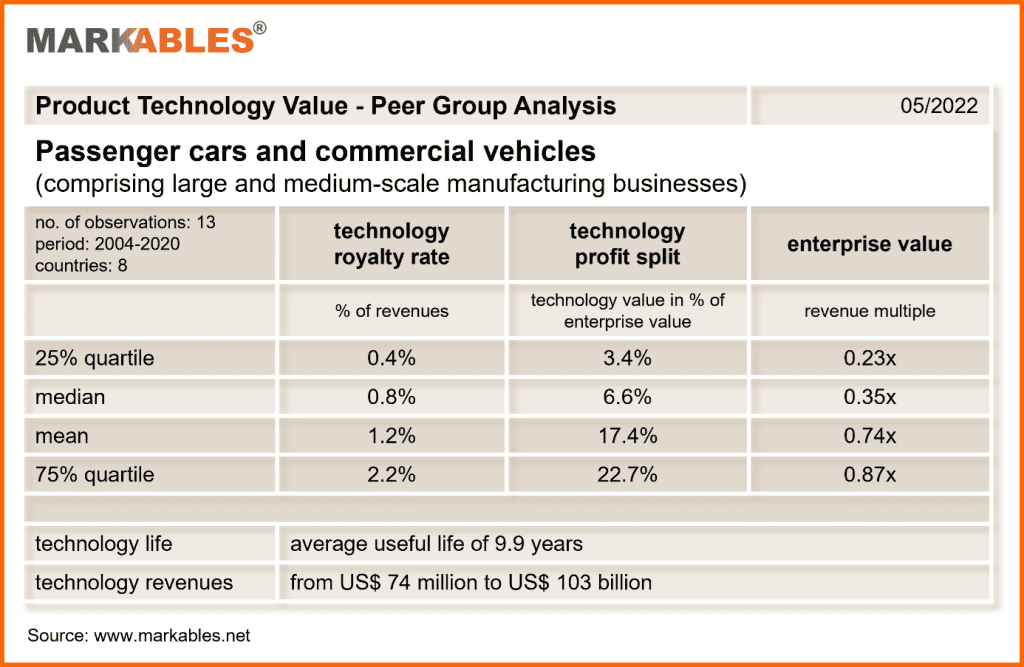

Next, we show a benchmarking analysis of tech-related comps that we find for manufacturers of passenger cars and commercial vehicles. The peer group includes famous global suppliers like Porsche, General Motors, Chrysler, Fiat, Saab, MAN, and more. The value of their product technology (excluding IPR&D) supports a royalty rate of 1% on total revenues on average. Not much, but plausible for various reasons.

Firstly, large volume cars incorporate a lot of experience cumulated over millions of models and cars produced. Technology is complex, but most of it has become common sense and available to all players within the sector. Secondly, large portions of the value added of a car comes from suppliers who in turn own and control the technology incorporated in subsystems and parts. And thirdly, overall return on revenues of car manufacturers in the volume segment is rather limited and does not support very high returns on intangible assets (profit split).

Technology value as percent of enterprise value (technology-based profit split) is somewhere between 10% and 15%. It must be added that car manufacturers are rarely acquired showing peak performance indicators; typically, they are in some sort of troubles or distress when taken over. Therefore, sales multiples upon acquisition are quite low, around 0.5x, explaining (in parts) the low ratios for technology-related comps.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland