June 16, 2022

Software and digital technologies are a major driver of enterprise value and M&A transactions, both in the software sector and in sectors that fully rely on digital business models. In a few days, MARKABLES will launch a new set of comparable data, ratios and royalty rates to support the valuation of software assets. This new dataset comprises 2,750+ different cases of different software and digital technology, and another 3,000+ different cases of product technology. In this post, we give an impression about what our users can expect from software and digital asset related comps.

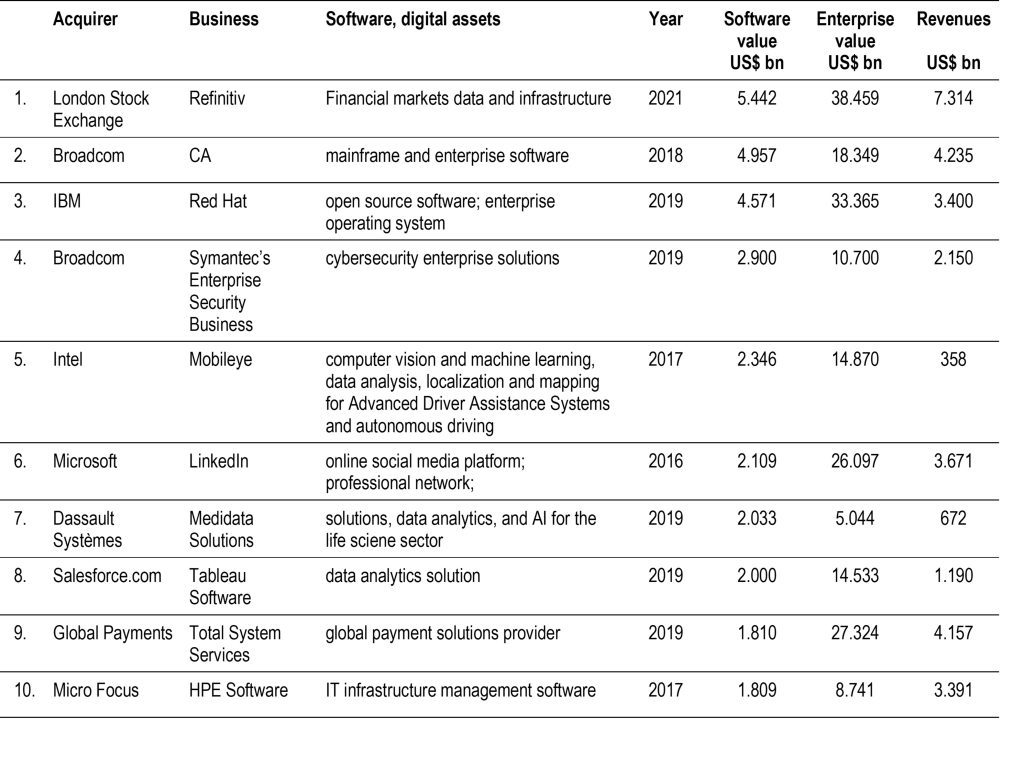

The values of the ten most expensive software assets in our database range from 1.8 to almost 5.5 bn US$. They span from third party software, AI, cybersecurity, online platform, fintech to telecom. Thus, there is a very strong trend towards increasing appreciation and value of software assets. Our frontrunner is the software portfolio of Refinitiv (formerly Thomson Financial), acquired by London Stock Exchange in 2021.

All businesses in the Top10 have been acquired (and valued) in the last 5 years, while our observations begin in the year 2000. The 10 most expensive software portfolios account on average for 17% of enterprise value, and they show a stunning excess earnings margin (or royalty rate) of 47% on revenues (!), over a short remaining life of 6.4 years. What we see here is the king’s class of digital businesses, with heavy and continuous investments in software and digital assets.

The table illustrates that software as a category of intangible assets, and its valuation multiples, have exploded through the last couple of years. The development, storage and distribution of software and digital assets is particularly demanding in terms of protection, infringement, fraud, and obsolescence/life cycle management.

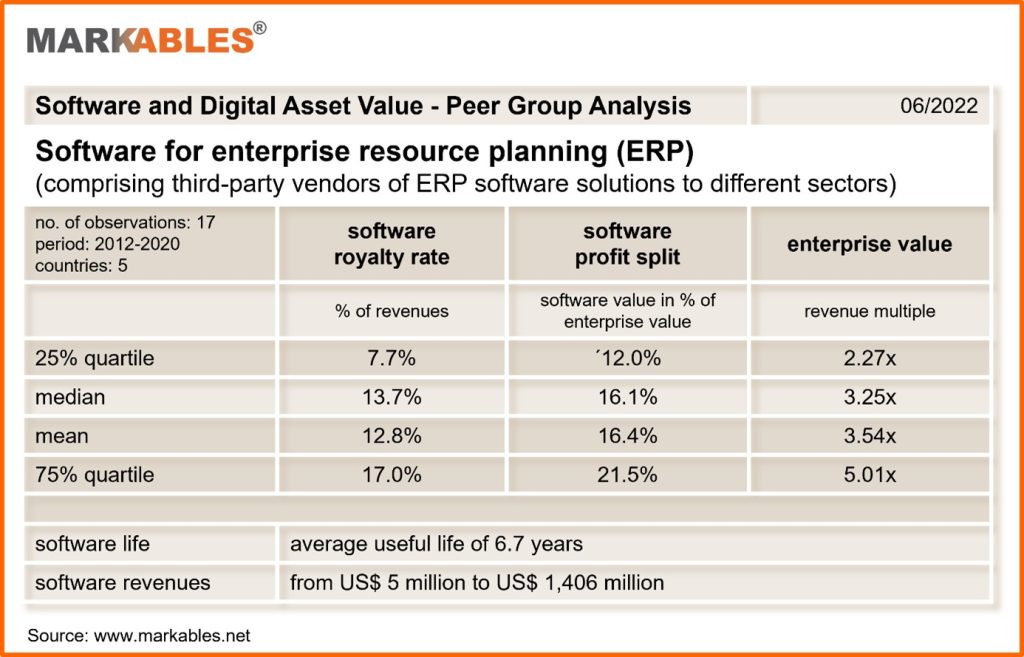

Now, we show a benchmarking analysis of software-related market comps that we find for vendors of third-party enterprise resource planning software (ERP). ERP is the integrated management of main business processes, often in real time and mediated by software and technology. ERP is usually referred to as a category of business management software — typically a suite of integrated applications — that an organization can use to collect, store, manage, and interpret data from many business activities.

The third-party software products support a royalty rate of 13% to 14% on revenues, over a useful life of less than seven years. Software accounts to 16% of enterprise value, for businesses that acquired at high sales multiples of 3.5x. It is important to understand that the royalty rates are for full ownership in the software, and for the possibility to make it accessible (or sublicense it) to many different users.

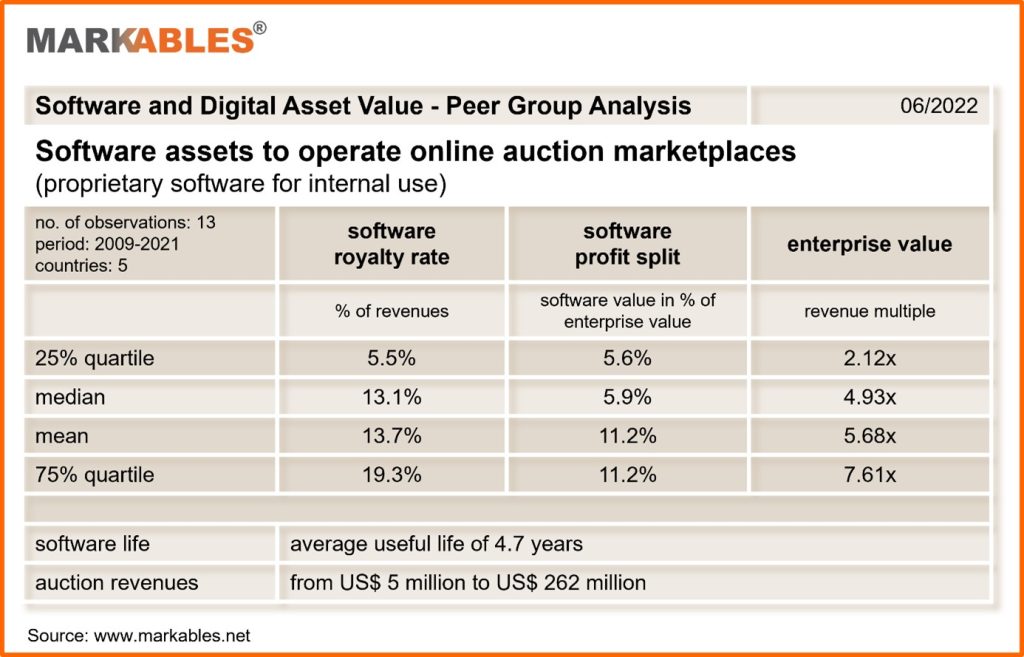

To change perspective, we now have a look at internal use software assets. In other words, at software of businesses that rely on a fully digital business model, and on a proprietary software serving as the backbone of all major business processes. To do this, we composed a peer group of businesses that operate an online auction marketplace.

Software related comps are not that much different from third-party software vendors. Similarly, software-related royalty rates are 13% to 14% of revenues. Remaining life is a little shorter, with 4.7 years. Share of software in enterprise value is also smaller (6%-11%), while sales multiples of acquired online auction businesses are even higher than for software vendors.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland