November 16, 2020

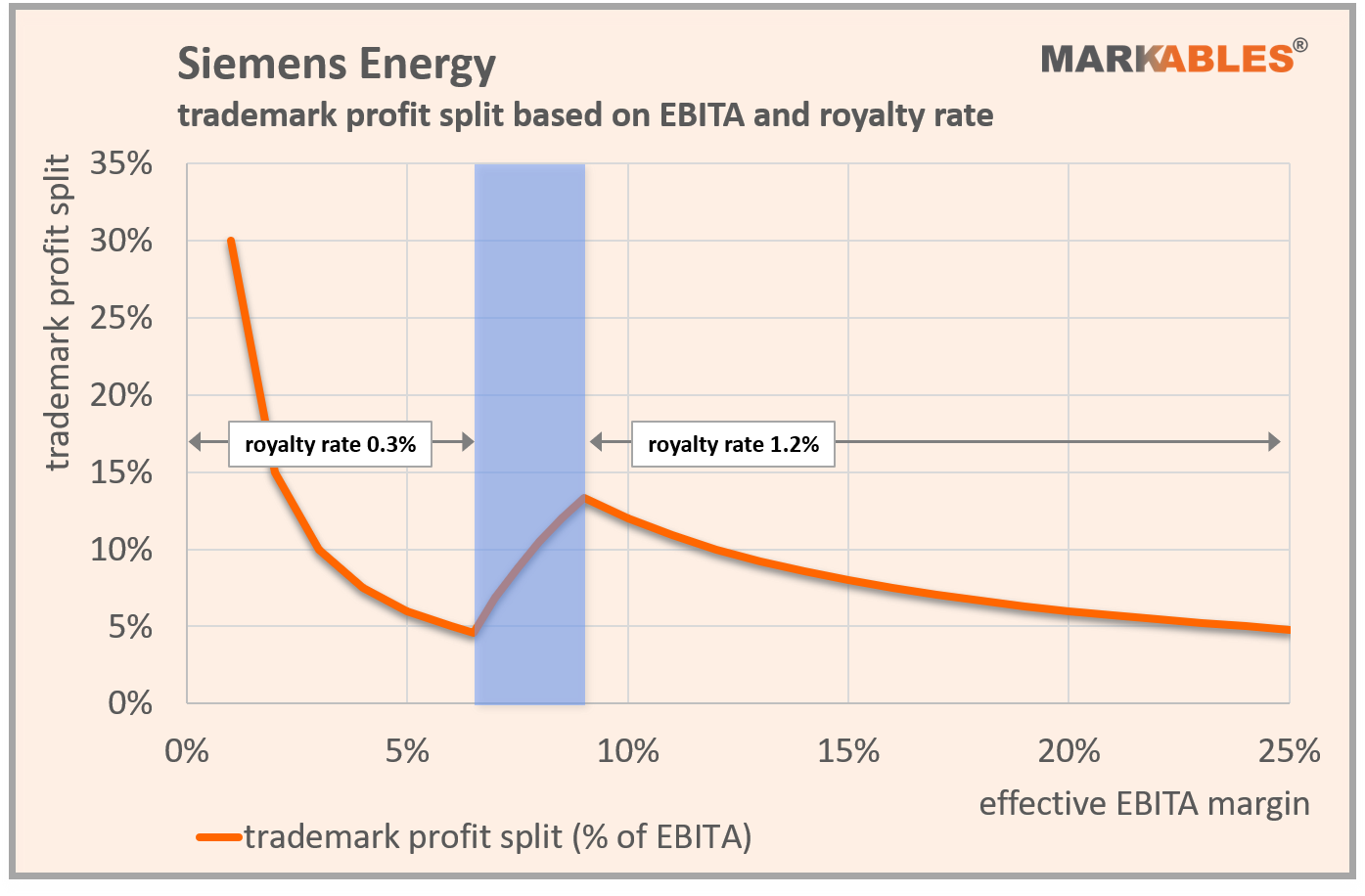

In almost all cases, royalty rates for license rights to use trademarks and brand names are based on revenues. Often, appraisers cross-check such rates for their reasonableness, by relating the royalty rate to a revenue-based profit rate for the licensed business. The royalty rate passes this check if a reasonable part of the profit of the licensed business is for the trademark license, often between 25% and 33%, depending on the trademark and the profit base. This method is called the profit split, and the 25%-33% range is the profit split rule of thumb.

While the profit split principle (the “reasonableness”) is meaningful, the rules of thumb are not, and never were, as is shown in a recent real-life case below.

For the 2020 spin-off (demerger) and listing of its global energy division, German-based Siemens AG entered into a trademark license agreement with the new unit to be named “Siemens Energy AG”. Accordingly, Siemens Energy AG is entitled to use the Siemens Energy brand name under certain terms and conditions, and for the payment of a license fee ranging between 0.3% (if the EBITA Margin is less than or equal to 6.5%) and 1.2% (if the EBITA Margin is equal to or greater than 9%) of revenue (see the IPO prospectus of Siemens Energy here, released on Sept 7th 2020, on page 475).

Let us note:

For a discussion of the internal valuation, licensing, tax valuation and transfer pricing of the Siemens trademark, see our post here.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland