April 26, 2022

2021 has been a high-octane year for mergers and acquisitions (M&As) in the FinTech world. The FinTech industry, which initially came to the fore on the promise of competitive disruption, has come through the ranks and has matured towards collaboration and consolidation. 2021 was a breakout year for M&As with well over 800 M&A deals, showcasing massive consolidation across key FinTech sectors such as Digital Banking, Payments, Buy Now Pay Later (BNPL), Lending, Wealth Management, Insurance, FinTech Infrastructure, and Decentralized Finance (DeFi).

We have recently posted an analysis of the trademark intangible assets of FinTechs here. Accordingly, appropriate trademark royalty rates are 2.1% for online brokers on average, and 1.2% for payment services. Trademarks are typically short-lived and account for less than 5% of enterprise value. Further, we have posted an analysis of the customer related intangible assets of FinTechs here. We found them to be much more important than the trademarks. As average, customer excess margins are 20.6% on revenues for electronic payment service providers, and 12.6% for online brokers. Customer relations have a useful life of 10.3 years and account for over 20% of enterprise value.

The final question in this context is about the value of the technology/software asset. As the wording FinTech implies, technology is expected to play a major role. Our analysis reveals that this is true, but technology is not the dominating asset of FinTechs, it is somewhere in between customer relations and trademarks.

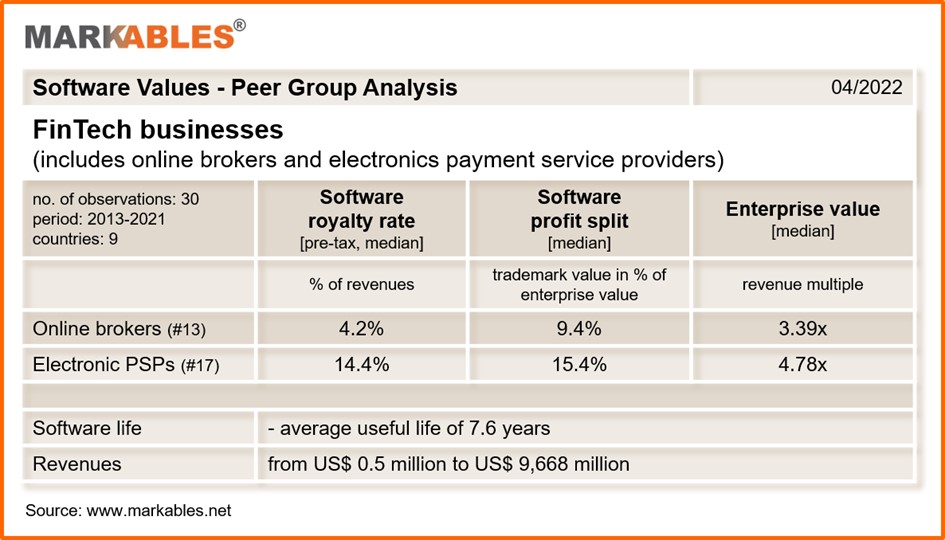

As for online brokers, the average appropriate royalty rate on their proprietary software is 4.2%, and the value of the software assets accounts for 9.4% of enterprise value. For PSPs, the royalty rate on software is 14.4%, and the asset accounts for 15.4% of enterprise value. Useful life of software is shortest of all types of IP, with 7.6 years.

To resume: FinTechs are very much tech driven, but their technology unfolds its true benefit in efficient, long-lasting customer relations. This “bundle” can be found very often in today’s digital economy. Digital technology is typically very much customer-centric. Technological advantage results in strong, valuable customer relations.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland