March 10, 2022

2021 has been a high-octane year for mergers and acquisitions (M&As) in the FinTech world. The FinTech industry, which initially came to the fore on the promise of competitive disruption, has come through the ranks and has matured towards collaboration and consolidation. 2021 was a breakout year for M&As with well over 800 M&A deals, showcasing massive consolidation across key FinTech sectors such as Digital Banking, Payments, Buy Now Pay Later (BNPL), Lending, Wealth Management, Insurance, FinTech Infrastructure, and Decentralized Finance (DeFi).

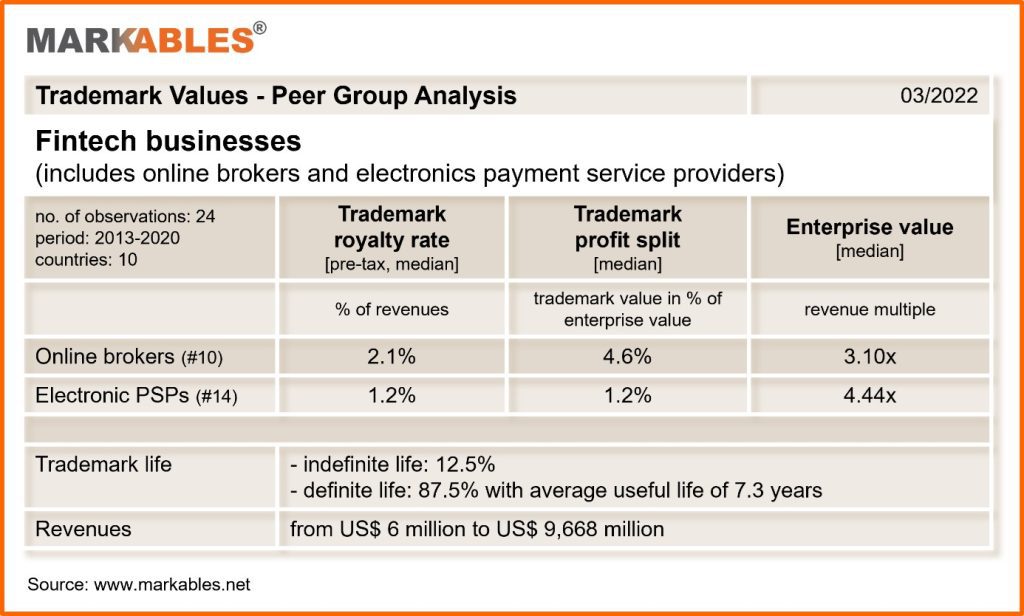

And yes, FinTechs do have brands which require valuations. Often, valuing the brand assets of tech-savvy businesses is a special challenge to the appraiser. MARKABLES had a closer look at comparable data from recently valued FinTech trademarks (see table), with a particular focus on online brokerage and electronic payment services

Appropriate trademark royalty rates are 2.1% for online brokers on average, and 1.2% for payment services. Trademarks are typically short-lived and account for less than 5% of enterprise value. The analysis shows that trademarks have a considerably higher importance for online brokers who are directly visible to their users, while payment services operate more in the background.

We will present customer and technology-related comparable valuation data for the same sector shortly. So please stay tuned …

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland