September 17, 2022

Have you ever heard of veterinary drug brands? Like Follistim®, Esmeron®, Frontline®, Ivomec®, Biomin®, to name a few. If not, don’t worry. It is a market for specialists (veterinarians), but a very profitable one. Although largely secret to the grand public, brands play an important role for those specialists.

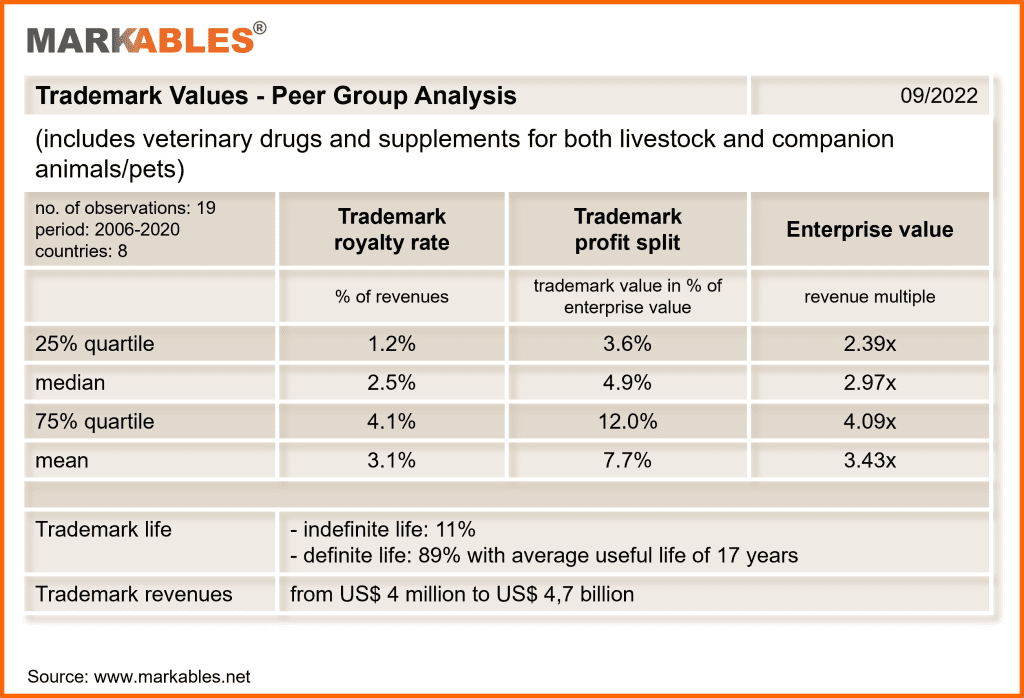

The vet drugs market is growing fast, and M&A is reaching record levels from year to year. MARKABLES had a closer look at past M&A transactions in the sector (for both livestock and pet drugs), and how intangible assets were valued. Not surprisingly, technology is the major asset class, followed by trademarks and brands. Appropriate trademark royalty rates are from 2.5% – 3%, and trademarks account for 5% – 8% of enterprise value. We found no differences between the livestock sector and the pet/companion animal sector.

The above ratios result from very profitable businesses. The EV multiples (revenue multiples) range between 3.0x and 3.5x on average, indicating high profitability and growth prospects.

In the next snapshot, we will have a look at the ratios for technology assets in vet drug sector.

In addition to trademark related data as shown above, MARKABLES offers comparable data on customer relations, technology, software and goodwill.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland