November 20, 2022

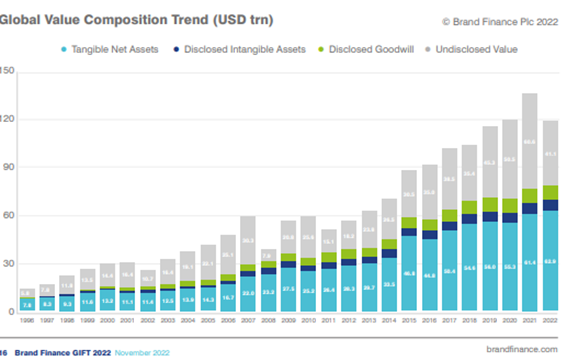

The value of global intangible assets falls by 25%, or 14 trillion US$(!), according to the lastest GIFT™ study released by Brand Finance last week.

Prima facie, this sounds quite dramatic for issuers and their balance sheets. On closer examination, there is little drama in this number.

How is intangible asset value measured in the GIFT™ study? It is the market cap of all listed companies worldwide, minus the book value of their tangible net assets. The difference relates to intangibles, both acquired/disclosed, and undisclosed. Market cap is measured some time in 2022 (maybe October?), while tangible assets are measured as of the latest reporting date.

Looking closer, the items disclosed on the balance sheets (and previously valued) are quite unaffected. The 25% difference is mostly attributable to stock price fluctuations. The MSCI World Index shows similar decline over the 12-month period from October 2021 to October 2022. Overall, disclosed intangible assets (i.e. acquired in business combinations) are much less sensitive to stock market fluctuations. The decline is mostly attributable to undisclosed (internally generated) intangible assets.

What does this mean for valuation activities? Well, there has been much discussion about goodwill impairments for the effects of the COVID pandemic. One full year of global goodwill impairments (mostly the 2021 impairments) is covered in the GIFT™ study. As the numbers suggest, goodwill added from acquisitions during the same period outweighed the negative effect of impairments. Still, there was (and still is) some stress level with the increased testing and measurement of goodwill impairments.

Regarding disclosed intangible assets, it was business as usual. A few indefinite lived intangible assets (i.e. trade names) required additional testing and impairment, but intangible assets with finite lives are typically resistant to impairments. Therefore, the global value of disclosed intangible assets increased during the 12 months as a result of additions from M&A (minus regular amortizations).

Calls for the disclosure of internally generated intangible assets are increasing, including the the GIFT™ study. While this would certainly be a breakthrough in the quality of management and financial reporting, the aspect of stock price fluctuations – as discussed above – is yet unadressed. If such fluctuations end up mostly in internally generated intangible assets (as opposed to the acquires intangibles), their disclosure/reporting would require frequent updating – in both directions and eventually by large numbers. A big challenge for management, valuators and accountants …

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland