October 12, 2023

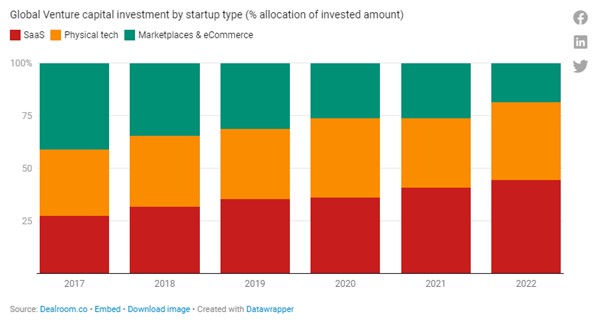

It’s no secret that investments in acquiring software companies have gained significant importance in recent years. However, there have also been considerable declines in this area since the peak of the trend in 2021. Nevertheless, early-stage investments in SaaS (Software as a Service) companies continued to grow in 2022 and 2023. The hype surrounding SaaS becomes particularly evident when you look at the structural shifts in the venture capital market. According to this, the share of investments in SaaS startups has risen from 27% in 2017 to 45% in 2022 (source: dealroom.com).

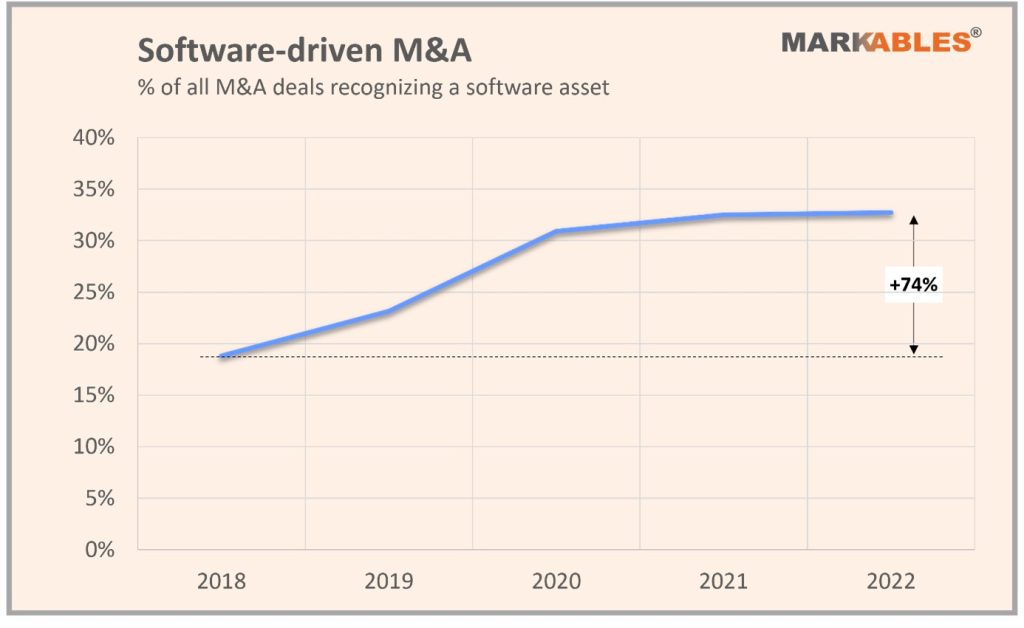

What do these investments in startups mean for more mature stock markets? Will early investments in SaaS companies eventually make their way there? The answer is a clear yes. Sooner or later, successful SaaS companies will find their way to the stock markets. If we look at acquisitions made by publicly traded companies, the proportion of SaaS companies is also increasing with similar growth rates as in the startup sector. This can be seen in the percentage of acquisitions where software is recorded as an intangible asset on the balance sheet. This proportion increased from 18.8% in 2018 to 32.7% in 2022. However, the increase came to a temporary halt in 2022.

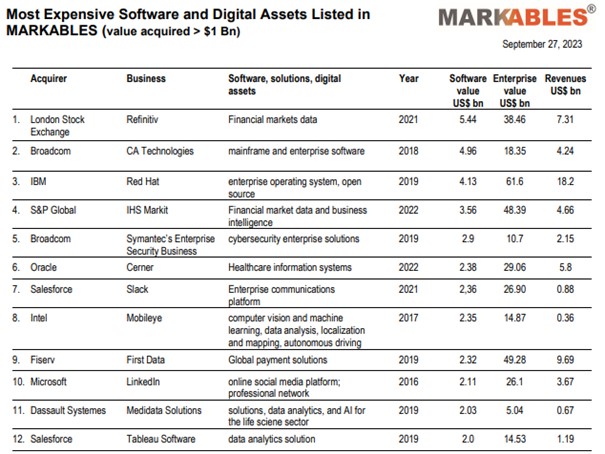

The strong growth in investments in software companies is also reflected in the valuation of software assets acquired in the public listed markets. As of today, we list twelve software assets in our database with a value exceeding two billion US dollars. Nine of these top twelve listings have only been acquired in the recent past, between 2019 and 2022. So, the sector is and will stay very dynamic.

One software-specific industry with strong growth rates is telehealth. Telehealth is the distribution of health-related services and information via electronic information and telecommunication technologies. It allows for long-distance patient and clinician contact, care, advice, reminders, education, intervention, monitoring, and remote admissions. Delivery can occur within four distinct domains: live video (synchronous), store-and-forward (asynchronous), remote patient monitoring, and mobile health. Telemedicine can be beneficial to patients in isolated communities and remote regions, enabling them to receive care from doctors or specialists far away without the need to travel. Remote patient monitoring through mobile technology can reduce the need for outpatient visits and enable remote prescription verification and drug administration oversight, potentially significantly reducing the overall cost of medical care. It may also be preferable for patients with limited mobility.

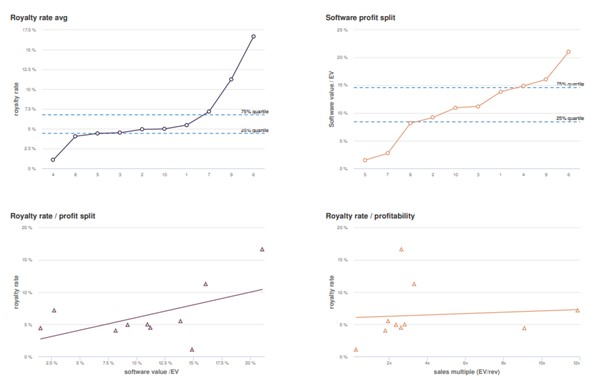

For companies offering telehealth solutions, the value of developed software typically ranges between 8% and 15% of the company’s overall value. Usual software royalty rates range from 4.5% to 7% of revenue.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland