July 17, 2014

Accepted opinion among trademark practitioners has it that trademarks are ageless and perpetual. Legally, no restrictions exist as to the limitation of the registration of a trademark over time and its continual renewals. Economically, the future lives of trademarks are often deemed indefinite, resulting in a valuation into infinity. As such, trademarks have a special position among intangible assets whose remaining life is typically finite and rather short-lived. In effect, many of the most famous brands of today accompany our lives since we were born and those of our parents and grandparents too.

Like with any other asset, the valuation of trademarks and brands under an income approach requires the projection of brand-related income into the future. In particular, the appraiser has to determine for how long he expects the brand asset to generate income and profits. This period – referred to as the useful life of a trademark – has a strong impact on its present value. The longer the asset generates profitable returns into the future, the higher is its present value.

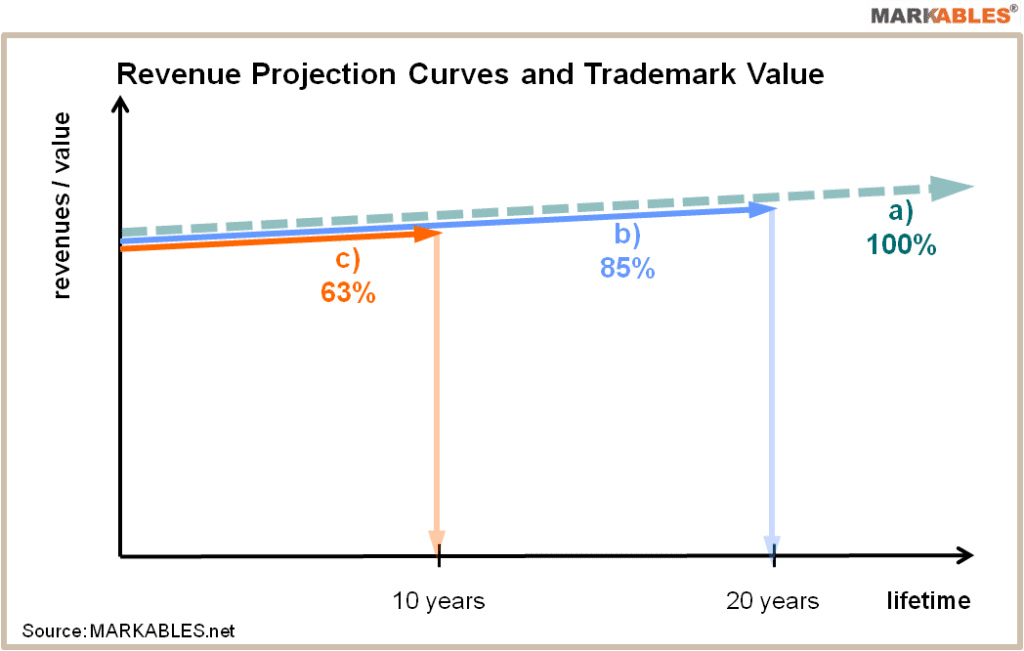

A period of 10 or 20 years of projected revenues, versus a revenue stream into perpetuity, makes a big difference in present value. The value of a trademark with indefinite useful life being 100, the same value declines to 85 for a 20 year life and to 63 for a 10 year life, all other factors being equal. This loss of value would be even greater if a declining revenue curve was assumed.

The determination of the useful life of a trademark is likely one of the most difficult tasks of an appraiser. Available methodologies include: product life cycle or category maturity analysis, market share stability and competition analysis, mergers and insolvencies, brand obsolescence, customer age structure, and other. Still, these methods can barely provide a precise calculation of useful trademark life.

IAS 38 provides some vague guidelines regarding the determination of the useful life of intangible assets. Accordingly, “An entity shall assess whether the useful life of an intangible asset is finite or indefinite and, if finite, the length of, or number of production or similar units constituting, that useful life. An intangible asset shall be regarded by the entity as having an indefinite useful life when, based on an analysis of all of the relevant factors, there is no foreseeable limit to the period over which the asset is expected to generate net cash inflows for the entity.”

IAS 38 further specifies that “the term ‘indefinite’ does not mean ‘infinite’”, and that “the useful life of an intangible asset reflects only that level of future maintenance expenditure required to maintain the asset at its standard of performance assessed at the time of estimating the asset’s useful life, and the entity’s ability and intention to reach such a level. A conclusion that the useful life of an intangible asset is indefinite should not depend on planned future expenditure in excess of that required to maintain the asset at that standard of performance.”

In short, IAS 38 encourages assuming an indefinite life if a) no limit is foreseeable, and b) the current level of maintenance expenditure is sufficient to maintain the performance of the trademark long-term.

On the other hand, IAS 38 requires considering many factors to determine the useful life of an intangible assets, including:

a. the expected usage of the asset by the entity and whether the asset could be managed efficiently by another management team;

b. typical product life cycles for the asset and public information on estimates of useful lives of similar assets that are used in a similar way;

c. technical, technological, commercial or other types of obsolescence;

d. the stability of the industry in which the asset operates and changes in the market demand for the products or services output from the asset;

e. expected actions by competitors or potential competitors;

f. the level of maintenance expenditure required to obtain the expected future economic benefits from the asset and the entity’s ability and intention to reach such a level;

g. the period of control over the asset and legal or similar limits on the use of the asset, such as the expiry dates of related leases; and

h. whether the useful life of the asset is dependent on the useful life of other assets of the entity.

The thorough consideration of these factors can lead the analyst to a view of brands having finite lives.

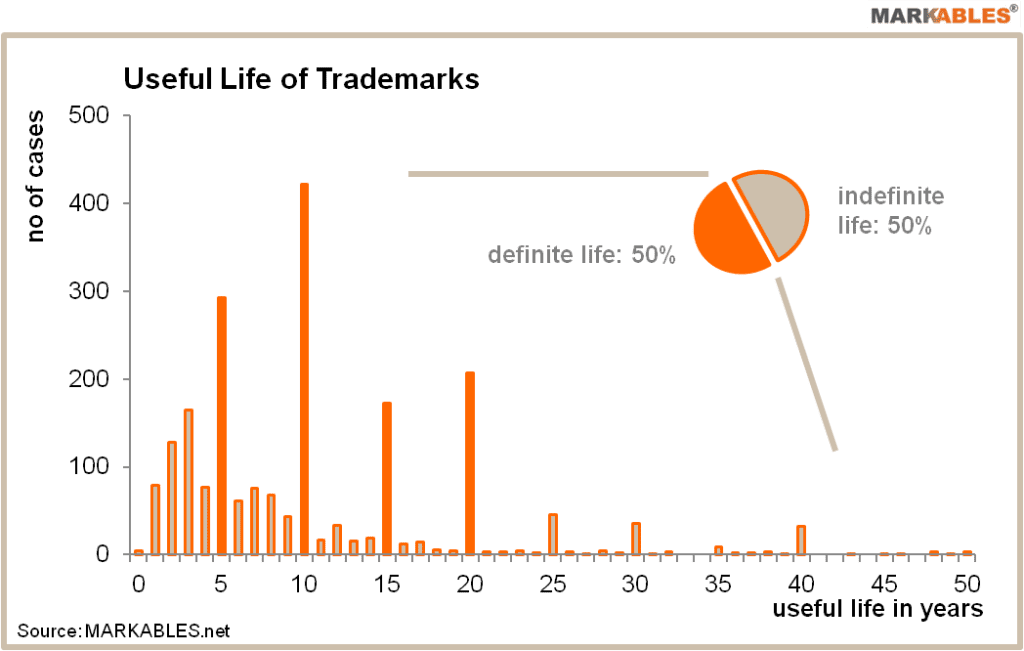

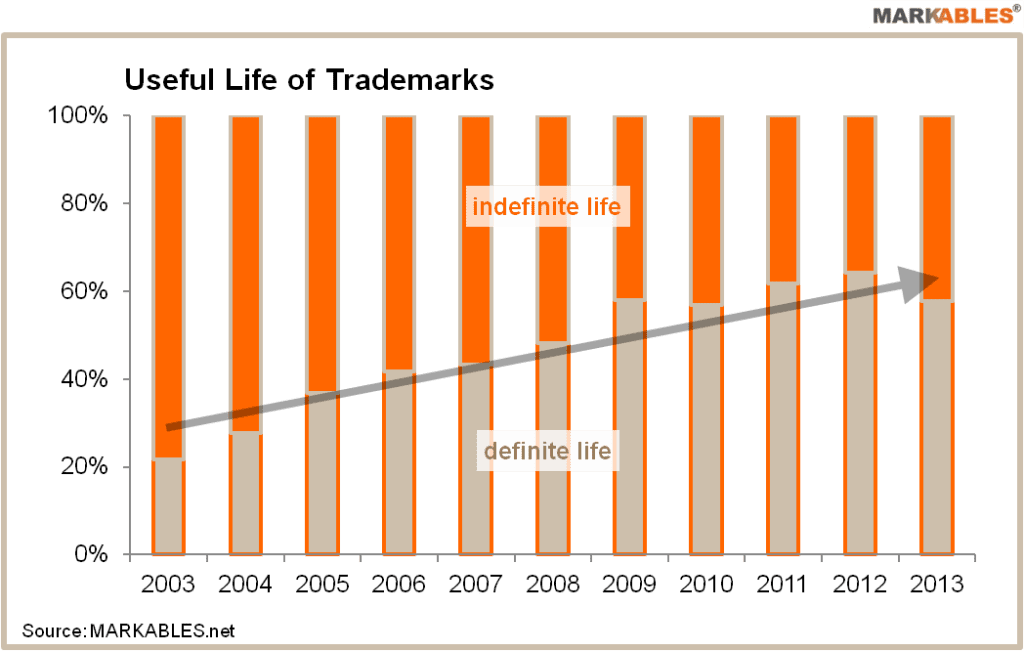

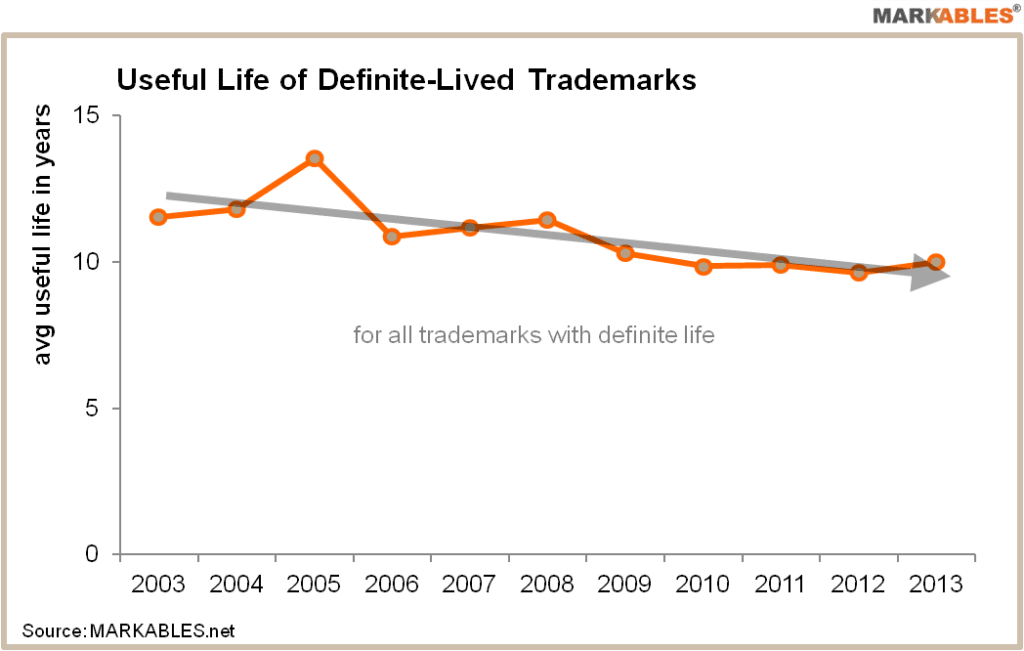

MARKABLES analyzed the useful lives assumed in the valuations of 4,500 trademarks and brands between 2003 and 2013. The average useful live found in this analysis is shorter than we expected, and it is even shortening over time. Overall, in precisely 50% of all trademark valuations it was concluded that no limit was foreseeable. Accordingly, an indefinite life was assumed and revenues from that trademark were projected into perpetuity. For the other half of the cases, the appraiser determined a definite future lifetime averaging 10.7 years. Listed below are the major findings:

More details are illustrated in the charts below.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland