June 10, 2022

In the run-up to the launch of the market comps for technology and software, we presented various extracts from our database.

We started with an overview of the most valuable technology portfolio , followed by sectors snapshots of car manufacturers and LED producers.

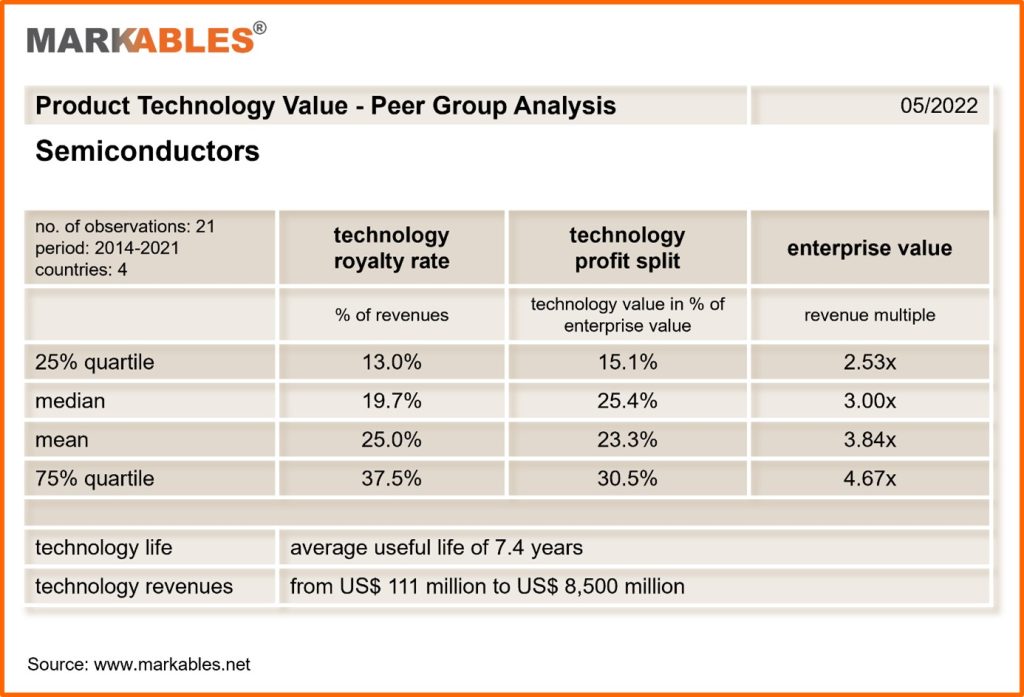

We conclude this little overview on technology intangible assets with a benchmarking at the very top level of hi-tech. For this, we composed a peer group in the semiconductor sector, comprising 21 acquired semiconductor businesses with revenues from $111 to $8,500 million. Typical royalty rates on technology are from 20% to 25% on revenues on average. That is a pretty bold number. The other tech-related ratios are impressive, too. Technology accounts for 25% of an enterprise value based on as much as 3x to 4x revenues. It is fair to say that technology is the dominating asset in the semiconductor sector, and that such businesses are acquired for the technology asset in particular.

Get relevant and robust market comps for your valuation within minutes.

Herrengasse 46a

6430 Schwyz / SZ

Switzerland